In today’s fast-paced digital world, the way we handle financial transactions is evolving rapidly. Contactless payment systems have emerged as a revolutionary technology, transforming the way we pay for goods and services. The benefits of contactless payment are manifold, offering unparalleled convenience, security, and efficiency. Here, we will explore the intricate features of contactless payment systems and their many benefits to consumers and businesses.

Understanding Contactless Payment

Contactless payment systems utilize RFID (Radio Frequency Identification) or NFC (Near Field Communication) technology to enable secure transactions between a card or device and a payment terminal. Unlike traditional payment methods, contactless payment users can tap their card or device near the terminal to complete a transaction. This innovation is encapsulated in various forms, such as contactless credit and debit cards, mobile wallets, and wearable devices.

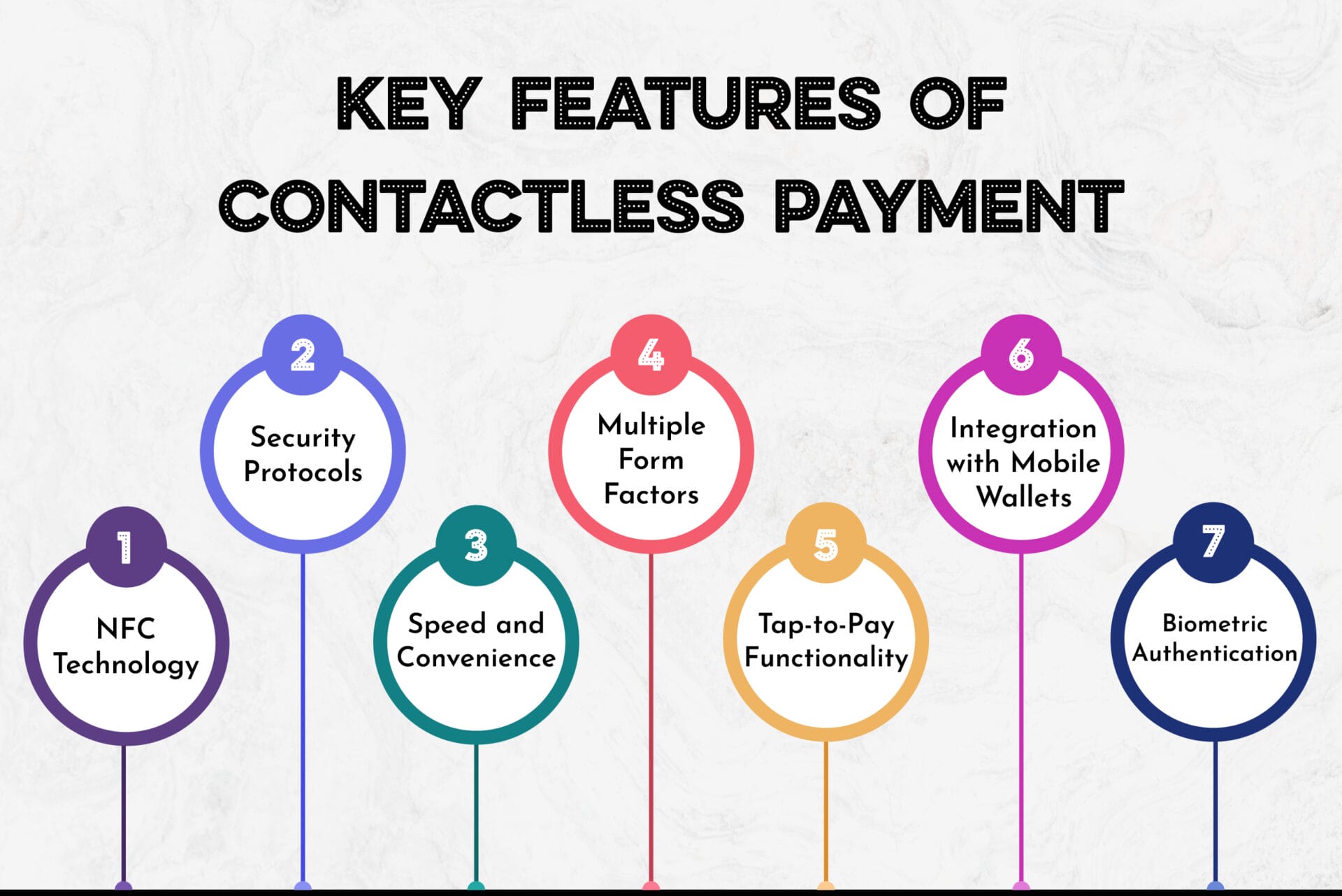

Key Features of Contactless Payment

- NFC Technology:

At the heart of contactless payment lies NFC technology, which allows data transmission over short distances. When a contactless card or device is brought within a few centimeters of the payment terminal, the NFC chip facilitates secure data exchange, completing the transaction swiftly and seamlessly.

- Security Protocols:

Security is a crucial concern in financial transactions, and contactless payments are designed with robust security measures. Encryption ensures that the data transmitted between the card/device and the terminal is protected. Tokenization further enhances security by replacing sensitive card information with a unique identifier or token, which is useless if intercepted.

- Speed and Convenience:

One of the standout features of contactless payment is its speed. Transactions can be finished in seconds, finishing significantly faster than traditional methods involving swiping, inserting, or manually entering card details.

- Multiple Form Factors:

Contactless payment technology is not limited to cards alone. It extends to smartphones, smartwatches, key fobs, and other wearable devices. This versatility enables users to select their preferred payment method, improving convenience and accessibility.

- Tap-to-Pay Functionality:

The tap-to-pay feature is intuitive and user-friendly. Users simply tap their card or device on the payment terminal, eliminating the need for PIN entry or signatures for small transactions. This ease of use makes contactless payments particularly popular for everyday purchases.

- Integration with Mobile Wallets:

Contactless payments are seamlessly integrated with popular mobile wallets such as Apple Pay, Google Pay, and Samsung Pay. These digital wallets store multiple cards, allowing users to effortlessly switch between different payment methods.

- Biometric Authentication:

Many contactless payment systems include biometric authentication features like facial or fingerprint recognition for add-on security. This minimizes unauthorized transactions, even if a device is lost or stolen.

The Benefits of Contactless Payment

- Speed and Efficiency:

One of the primary benefits of contactless payment is the significant reduction in transaction time. Transactions can be finished in just a few seconds, translating into shorter queues, faster service, and a smoother customer experience. This is particularly beneficial in high-traffic environments like retail stores, restaurants, and public transportation.

- Enhanced Security:

– Reduced Fraud: Encryption and tokenization make it intensely difficult for fraudsters to intercept and misuse payment information. The unique token generated for each transaction ensures that even if data is intercepted, it cannot be used for subsequent transactions.

– Card Never Leaves Hand: With contactless payments, the card or device remains in the user’s possession throughout the transaction. This underrates the risk of card skimming and physical theft, providing peace of mind to consumers.

- Convenience:

– Ease of Use: The simplicity of tapping to pay eliminates the need to fumble with cash, coins, or card swiping. This is especially advantageous in situations where speed and ease are critical, such as boarding public transport or making small purchases.

– Multi-Purpose Devices: Smartphones and wearables equipped with contactless payment capabilities reduce the need to carry multiple cards. Consolidating payment methods into a single device enhances convenience and reduces clutter.

- Hygiene

After the COVID-19 pandemic, many consumers have prioritized minimizing physical contact. Contactless payments reduce the need to touch payment terminals, enhancing hygiene and reducing the spread of germs. This has made contactless payment a preferred choice for health-conscious individuals.

- Integration with Loyalty Programs

Contactless payments can be seamlessly integrated with loyalty and rewards programs. This allows consumers to automatically accumulate points and redeem rewards without additional steps, enhancing the overall shopping experience and fostering customer loyalty.

- Global Acceptance

As contactless payment technology becomes more widespread, its acceptance by merchants worldwide continues to grow. This global reach is particularly advantageous for international travelers, who can use their contactless cards and devices abroad without the hassle of currency exchange or compatibility issues.

- Cost-Effective for Merchants

Contactless payments streamline business transactions, lowering transaction processing times and costs. Faster transactions mean businesses can serve more customers in less time, improving overall efficiency and revenue.

- Support for Small Transactions:

Contactless payment systems often allow for small transactions without requiring a PIN. This feature encourages the use of contactless payments for everyday purchases, such as coffee or groceries, where speed and convenience are paramount.

- Consumer Control:

Consumers appreciate the sense of control contactless payments provide. Since the card or device remains in the user’s hand, there is less anxiety about handing over a card to a cashier or waiter. This control contributes to a sense of security and trust in the payment process.

The Future of Contactless Payment

The adoption of contactless payment systems is poised to continue its upward trajectory. We can expect further security, speed, and convenience enhancements as technology advances. Innovations such as biometric authentication, blockchain integration, and expanded global acceptance will only strengthen the appeal of contactless payments.

Moreover, the shift towards a cashless society, accelerated by the COVID-19 pandemic, underscores the relevance of contactless payments. Consumers and businesses acknowledge the benefits of reduced physical contact, more secure and faster transactions, and improved security.

Conclusion

In conclusion, contactless payment systems represent a substantial leap forward in elaborating financial transactions. The benefits of contactless payment, including speed, security, and convenience, make it an engaging option for consumers and merchants alike. As we move towards a more connected and digital future, embracing contactless payments is not just a trend but an innovative and forward-thinking choice.

By comprehending and leveraging the features and benefits of contactless payment, we can enjoy a more efficient, secure, and convenient way of handling our financial transactions. Whether you’re a consumer looking for ease and speed or a business aiming to enhance customer satisfaction and streamline operations, contactless payment offers a captivating solution that meets the needs of the modern world.