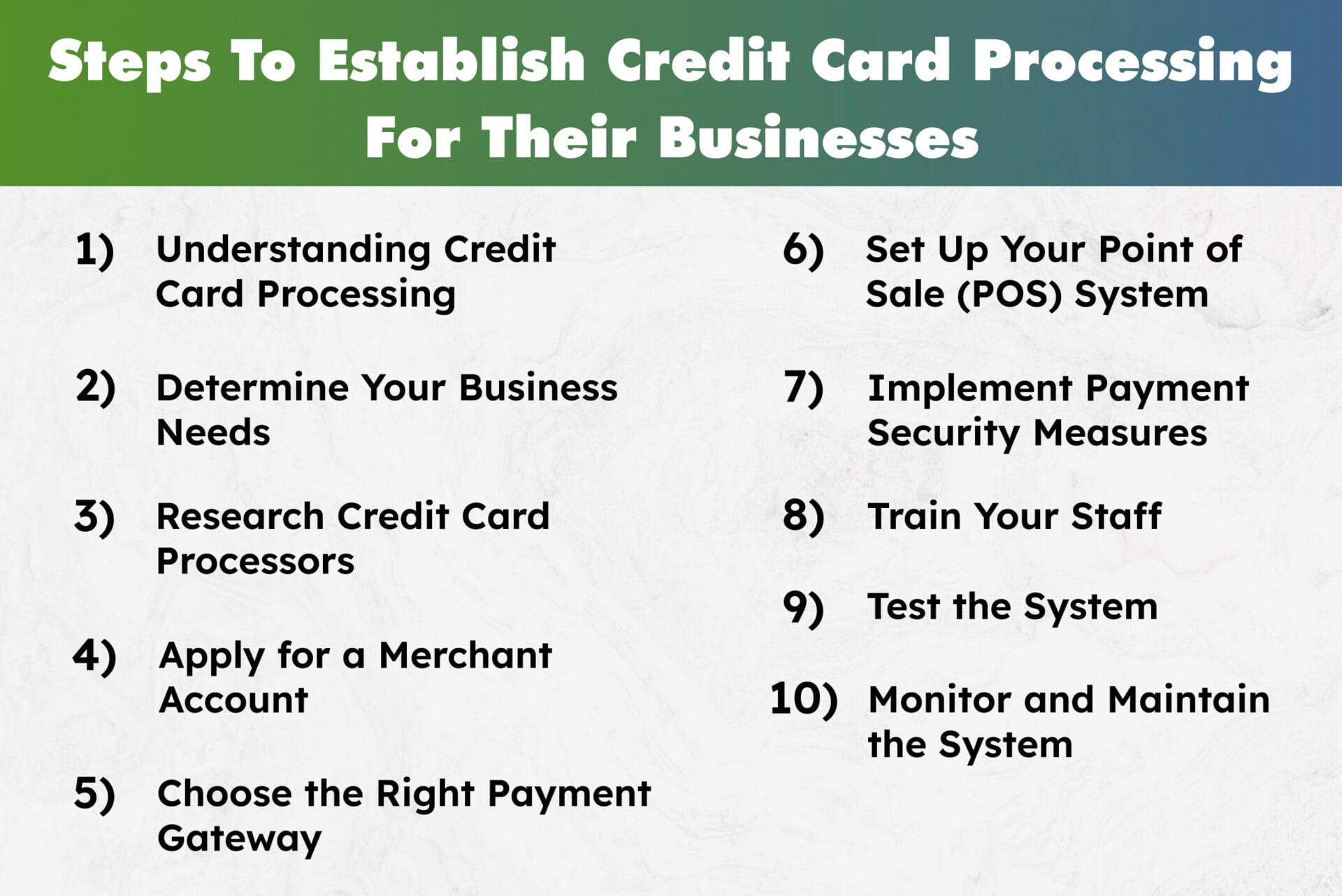

In the modern era of technology, small businesses must embrace credit card payments in order to expand and thrive in the competitive market. Implementing credit card processing not only improves customer convenience and sales but also streamlines business operations. However, the process of setting up credit card processing may seem overwhelming for individuals who need to become more familiar with it. This comprehensive guide is designed to help small business owners navigate through the necessary steps to establish credit card processing for their businesses.

- Understanding Credit Card Processing

Before diving into the setup process, it’s crucial to understand how credit card processing works. When a customer makes a payment using a credit card, several parties are involved:

– The Customer: The cardholder making the purchase.

– The Merchant: The business accepting the payment.

– The Acquirer: The merchant’s bank.

– The Issuer: The customer’s bank.

– The Payment Processor: The intermediary that handles the transaction.

The process involves:- Authorization (verifying the funds and transaction details).

- Authentication (confirming the cardholder’s identity).

- Settlement (transferring funds from the customer’s bank to the merchant’s account).

- Determine Your Business Needs

To choose the right credit card processing solution, you need to assess your business’s specific needs:

– Transaction Volume: Estimate the number of transactions and the average transaction size.

– Sales Channels: Consider whether you’ll be accepting payments in-store, online, or both.

– Integration Needs: Identify any existing systems (like POS systems or e-commerce platforms) that the payment processor needs to integrate with. - Research Credit Card Processors

Various credit card processors are available, each with pros and cons. Here are some popular options:

– Square: Known for its ease of use and no monthly fees, Square is ideal for small businesses and startups.

– PayPal: Offers comprehensive online payment solutions and is widely trusted by customers.

– Stripe: Popular for online businesses due to its robust API and customization options.

– Shopify Payments: Ideal for businesses using Shopify as their e-commerce platform.

When researching, consider factors like transaction fees, monthly fees, setup costs, contract terms, and customer support. - Apply for a Merchant Account

A merchant account is a type of bank account that allows your business to accept credit card payments. You can apply for a merchant account through your bank or a payment processing company. The application process typically involves:

– Providing Business Information: Including your business name, address, and tax identification number.

– Submitting Financial Statements: To prove your business’s financial stability.

– Undergoing a Credit Check: The provider will check your credit history to assess risk. - Choose the Right Payment Gateway

A payment gateway is a service that securely transmits credit card information from your website to the payment processor. For online businesses, this is a critical component. Some popular payment gateways include:

– Authorize.Net: A reliable and widely used payment gateway.

– PayPal Payments Pro:Offers robust features and integrates well with e-commerce platforms.

– Stripe:Known for its developer-friendly API and seamless integration.

Ensure your chosen payment gateway is compatible with your website or e-commerce platform. - Set Up Your Point of Sale (POS) System

You’ll need a POS system to process credit card payments if you have a physical store. A POS system includes hardware (card readers and terminals) and software for transactions. When choosing a POS system, consider:

– Ease of Use: The system should be user-friendly for both staff and customers.

– Integration: Ensure it integrates with your inventory management, accounting software, and other business systems.

– Security: Look for systems with robust security features to protect customer data. - Implement Payment Security Measures

Security is paramount when handling credit card transactions. Implement the following security measures:

– PCI Compliance: Ensure your payment processing setup complies with the Payment Card Industry Data Security Standard (PCI DSS).

– Encryption: Use encryption to protect cardholder data during transmission.

– Tokenization: Replace sensitive card information with a unique identifier (token) to prevent data breaches.

– Fraud Prevention Tools: Utilize tools like address verification services (AVS) and card verification value (CVV) checks to detect and prevent fraudulent transactions. - Train Your Staff

Your employees must be well-versed in using the new credit card processing system. Conduct training sessions to ensure they understand:

– How to Process Transactions: Including how to handle sales, returns, and exchanges.

– Security Protocols: Emphasize the importance of maintaining security and following protocols.

– Customer Service: Train staff on how to assist customers with payment-related queries and issues. - Test the System

Before going live, thoroughly test your credit card processing system to ensure everything works smoothly. Conduct test transactions to check:

– Functionality: Verify that transactions are processed correctly and promptly.

– Integration: Ensure the system integrates seamlessly with your other business tools.

– Security: Confirm that all security measures function as expected. - Monitor and Maintain the System

Once your credit card processing system is up and running, ongoing monitoring and maintenance are crucial. Review transaction reports regularly, look for discrepancies, and stay updated on the latest security practices. Additionally, maintain open communication with your payment processor to quickly address any issues that arise.

Conclusion:

Setting up credit card processing for your small business may seem complex, but following these steps ensures a smooth and efficient process. Understanding your business needs, choosing the right providers, implementing robust security measures, and training your staff are key components of a successful setup. With credit card processing in place, you can offer a better customer experience, increase sales, and grow your business.