Contactless payment has recently seen a meteoric rise, revolutionizing how transactions are conducted. This payment method has become extremely popular due to its user-friendly interface and robust security features. Understanding the benefits of contactless payments can provide valuable insights for businesses and consumers.

How Do Contactless Payments Work?

Did you know contactless payments rely on Near Field Communication (NFC) technology? This incredible technology enables devices to communicate with each other when they are brought into close proximity. With contactless payment, you can enjoy a seamless and secure payment experience without needing cash or cards. Try it out today and experience the convenience of contactless payments! This technology facilitates the seamless transfer of payment information between the customer’s contactless card or mobile device and the payment terminal, allowing for swift and secure transactions without the need to physically swipe or insert the card.

Types of Contactless Payment Methods

There are various types of contactless payment methods, including contactless credit and debit cards, as well as mobile payment solutions such as Apple Pay, Google Pay, and Samsung Pay. These methods enable users to make payments by tapping the card or device on a contactless-enabled terminal, making the transaction process incredibly convenient and efficient.

Accepting Contactless Payments

Businesses can integrate contactless payment terminals to accept contactless payments, providing customers with a seamless and secure payment experience. This involves adopting new payment terminals capable of processing contactless transactions, thereby enhancing the overall payment process for the company and its clientele.

What Are the Benefits of Contactless Payment?

The adoption of contactless payment methods offers a myriad of benefits to both businesses and consumers. These advantages contribute to the growing preference for contactless transactions over traditional payment methods.

Convenience and Speed

Contactless payments provide unmatched convenience and speed, allowing customers to make transactions swiftly and efficiently. The streamlined process eliminates the need to fumble for cash or wait for card authorization, enhancing the overall shopping experience for consumers.

Enhanced Security Features

Contactless payments offer enhanced security features, significantly reducing the risk of card information theft or fraud. The use of encrypted communication and tokenization makes contactless transactions a secure payment method, ensuring the protection of sensitive payment information.

Increased Customer Satisfaction

The seamless and hassle-free nature of contactless payments contributes to heightened customer satisfaction. The swift and secure transaction process enhances the overall shopping experience, leading to greater customer loyalty and positive brand perception.

What Are the Advantages and Disadvantages of Contactless Payment?

Despite the numerous advantages of contactless payments, it is important to consider their potential drawbacks and compare them with traditional payment methods to understand their impact comprehensively.

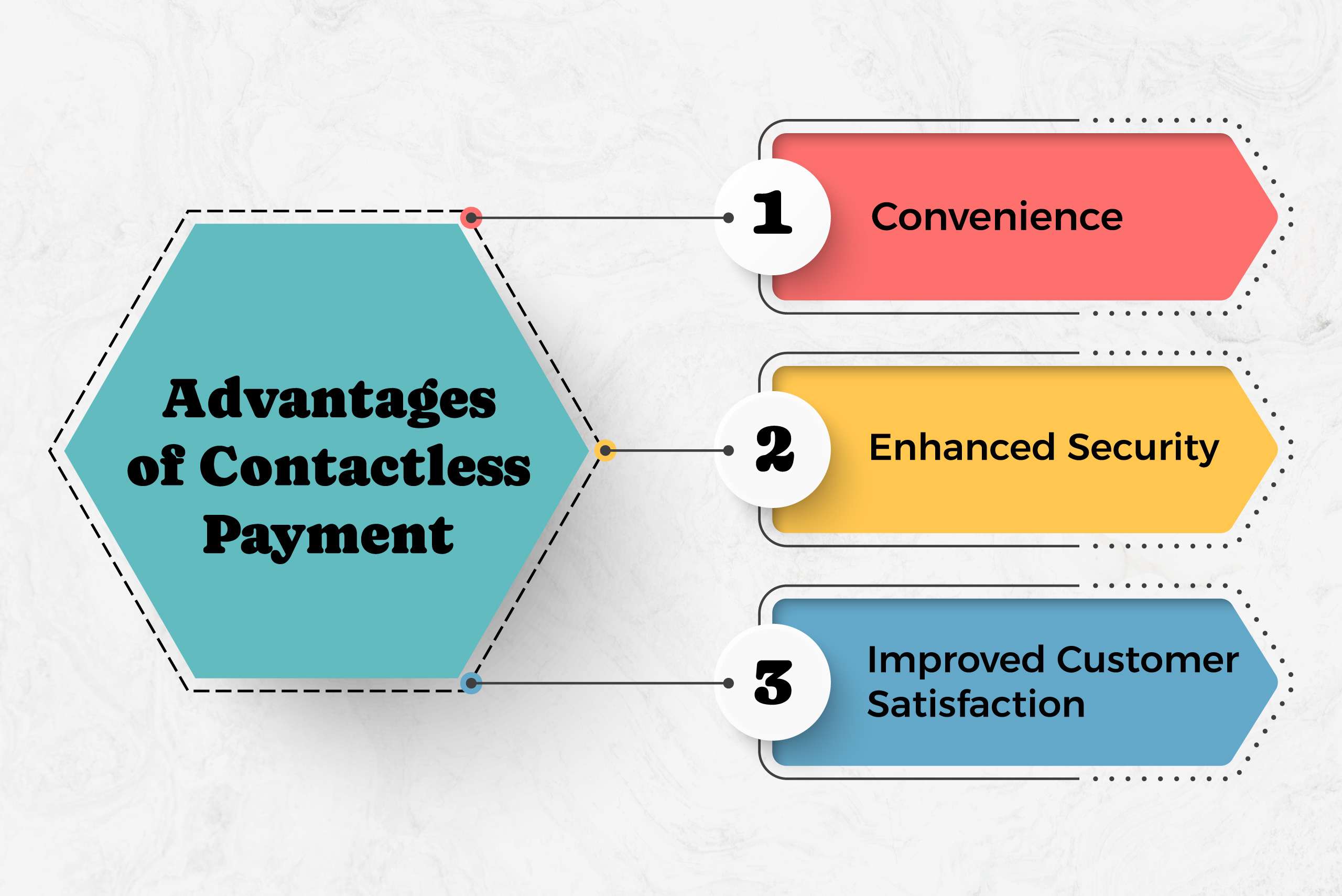

Advantages of Contactless Payment

The advantages of contactless payment include convenience, enhanced security, and improved customer satisfaction, making it a preferred choice for both businesses and consumers. Contactless transactions offer unparalleled speed and efficiency, contributing to a seamless payment experience.

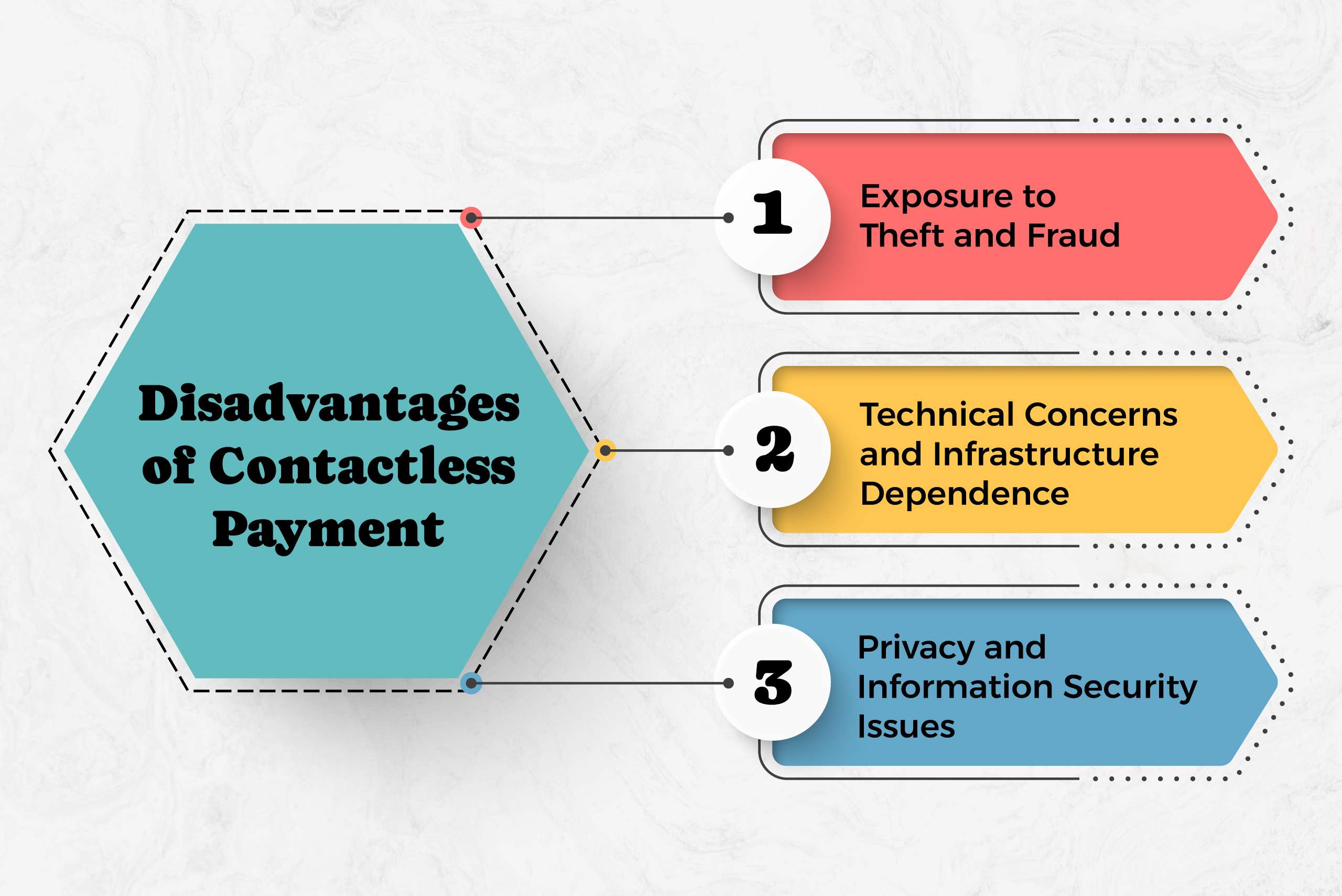

Disadvantages of Contactless Payment

While contactless payments offer significant benefits, some potential disadvantages include susceptibility to technical glitches and the limited acceptance of contactless methods in specific regions or establishments. Additionally, concerns about privacy and data security may arise among some consumers.

Exposure to Theft and Fraud

Wireless, contactless payments are vulnerable to theft and fraud due to weaknesses in NFC systems that criminals can exploit to intercept or clone payment data.

Technical Concerns and Infrastructure Dependence

Stable infrastructure and technology are paramount for successful contactless payments. Any disruptions in network connectivity or technical issues can significantly impede transactions, rendering them ineffective.

Privacy and Information Security Issues

Contactless payments have raised concerns regarding privacy and data security, as transaction data containing purchase information is collected and stored with each transaction.

Comparison with Traditional Payment Methods

Contactless payments are faster and more convenient than traditional payment methods such as cash or chip-and-PIN transactions. However, traditional methods may still hold advantages regarding universal acceptance and familiarity among certain consumer demographics.

What Is the History and Evolution of Contactless Payment?

Understanding the historical progression and ongoing evolution of contactless payment technology provides valuable insights into its widespread adoption and future trends.

Brief History of Contactless Payment

The concept of contactless payment first emerged in the late 1990s, and it has since undergone significant advancements in technology and market integration. Early innovations paved the way for developing secure and efficient contactless payment methods, shaping the modern landscape of electronic transactions.

Examples of Contactless Payment Innovations

Leading technology companies and financial institutions have continually innovated in the realm of contactless payments, introducing groundbreaking solutions such as pay-by-face recognition and wearable payment devices. These innovations have propelled the evolution of contactless payment technologies, offering new and convenient ways to make secure transactions.

The Future of Contactless Payment Technology

The future of contactless payment technology holds immense potential, with advancements in biometric authentication, seamless integration with Internet of Things (IoT) devices, and the proliferation of contactless-enabled wearables. These developments are poised to revolutionize the payment landscape further, offering unprecedented convenience and security for consumers and businesses alike.

How Can Businesses Utilize Contactless Payment Systems?

Businesses can leverage the advantages of contactless payment systems to enhance their overall operations and customer satisfaction, thereby staying ahead in an increasingly digital and connected economy.

Adopting Contactless Payment Terminals

Companies can adopt contactless payment terminals to streamline their payment processes, allowing for quick and secure transactions. By embracing contactless technology, businesses can cater to evolving consumer preferences and pave the way for enhanced payment experiences.

Accepting Contactless Payment via Mobile Devices

Mobile payment solutions such as Apple Pay and Google Pay enable businesses to accept contactless payments using mobile devices, expanding the range of payment options available to customers. This versatility provides added convenience for both businesses and consumers, contributing to a seamless transaction ecosystem.

Integration with Existing Payment Solutions

Integrating contactless payment solutions with existing payment systems allows businesses to leverage the benefits of contactless transactions while maintaining compatibility with their established infrastructure. This integration ensures a smooth transition to contactless payments and facilitates a cohesive payment environment for the company and its clientele.

Today, contactless payments are becoming increasingly popular, and the global contactless payment market is estimated to be worth over $100 billion by 2023. The appeal of contactless payment for consumers is clear: it’s incredibly convenient, quickly and securely allows users to make payments, and eliminates the hassle of carrying cash or credit cards. However, businesses also benefit greatly from contactless payments.

Contactless payment refers to any non-traditional payment method that doesn’t require physical contact between the transaction and the user. This includes Ezzy Payments, digital wallets, NFC cards, and more. Credit card companies have been remarkably eager to jump on board this new technology and are now offering contactless payment technology as an option for their customers.

Businesses can benefit significantly from contactless payment technology. First, it helps to reduce transaction times, as users don’t need to input long strings of numbers or wait for a card to be swiped. Furthermore, it is much more secure than using cash or traditional credit cards, as contactless payments are heavily encrypted and impossible to copy or counterfeit. Finally, contactless payment allows businesses to collect valuable customer data, such as their purchasing habits or whether they prefer contactless payments. This data can then be used to tailor promotions and increase customer engagement.

The case for contactless payment is only growing more robust, and businesses should take advantage of this technology sooner rather than later. The number of users is only increasing thanks to large-scale credit card companies offering contactless payment options. Additionally, as new technologies such as Apple Pay and Google Wallet continue to develop, contactless payment will only become more commonplace. Businesses can gain a competitive edge by embracing contactless payment and making their customers’ lives more convenient.