Accepting credit card payments is a must for restaurants in today’s cashless world. With the majority of diners now preferring the ease and security of paying with a card rather than using cash, having reliable and cost-effective credit card processing is critical for your restaurant’s success.

This ultimate guide will walk you through everything restaurant owners need to know about setting up, managing, and optimizing credit card processing. We’ll cover the basics of how it all works, compare the best processors and systems for eateries, detail common fees to expect, and provide tips to minimize processing expenses so you can maximize profits. Let’s dive in!

How Credit Card Processing Works for Restaurants

So, how exactly does credit card processing work for the restaurant industry? Here is a quick step-by-step overview:

- A customer pays for their meal with a credit or debit card. This may be via a chip reader, tap payment, or by swiping the card through a magnetic stripe reader.

- Your restaurant’s point of sale (POS) system or credit card terminal captures the credit card information and sends it via a secure internet connection to a payment processor.

- The payment processor verifies the credit card information with the bank that issued the customer’s card.

- Once approved, the bank transfers the funds to the payment processor, minus an interchange fee.

- The processor deposits the payment amount into your restaurant’s bank account, after deducting their processing fees.

- The funds become available in your checking account within 1-3 business days on average.

Some key players, fees, and concepts involved include:

– Card networks like Visa, Mastercard, American Express and Discover set the interchange fees and qualifications for transactions.

– Issuing banks provide credit and debit accounts to customers.

– Payment processors like Square facilitate transactions between merchants (restaurants), card networks, and issuing banks.

– Interchange fees are charged by card networks per transaction. They average around 1.5% – 2.5%.

– Payment processor fees average from 2.3% – 3.5% on top of interchange fees per transaction.

Understanding these fees is key for restaurants to maximize profits on credit card sales while maintaining top-notch systems and equipment for processing transactions seamlessly. We’ll break down these costs more a bit later.

Choosing the Best Credit Card Processing For Your Restaurant

One trusted and cost-effective payment processor for restaurants to consider is Ezzy Payment. Specializing in seamless POS integrations and interchange-plus pricing packages, Ezzy Payment aims to simplify card processing fees for restaurateurs while providing robust reporting and excellent customer support. Their restaurant-tailored solutions make accepting credit cards easy across dine-in, take out, and delivery orders.

Selecting the right payment processing solution for your restaurant is crucial. You want systems that integrate smoothly with your point of sale software, keep transaction costs low, offer excellent equipment and customer support, and provide transparent pricing.

Here are the most important factors restaurateurs should consider when evaluating credit card processing systems and service providers:

– Pricing & Fees – Compare rates, interchange plus pricing, monthly fees, long-term contracts.

– Software Integration – Choose a processor that easily integrates with your POS system.

– Equipment – Quality terminal, EMV chip compliance, tap payment enabled.

– Data Security – End-to-end encryption a must.

– Customer Support – Responsive team that’s restaurant-savvy.

– Reporting & Analytics – Robust reporting on sales trends and server performance.

Understanding the types of fees involved is also key for choosing the right processor.

Breakdown of Credit Card Processing Fees for Restaurants

As a restaurant payment processing leader focused on transparency and cost control, Ezzy Payment is upfront about every fee involved so you can maximize profits on credit card transactions. From interchange rates to assessment fees, chargebacks and more – the Ezzy Payment team keeps merchants informed on all processing expenses while working hard behind the scenes to reduce these costs through advanced integration partnerships.

When it comes to credit card processing costs for restaurants, pricing can get complex quickly. However, you need visibility over the exact fees deducted per transaction in order to maximize profits.

Here are the primary credit card processing fees restaurants need to stay aware of:

Interchange Fees

The interchange fee goes to the card networks like Visa or Mastercard. It averages 1.5% to 2.5% per transaction. The exact percentage is based on:

– Card type – rewards cards have higher interchange costs. Debit cards are lowest.

– Card brand accepted – American Express tends to have the highest interchange fees.

– Transaction size – purchases under $15 can have higher rates.

– Transaction type – card-not-present transactions like online ordering have higher fees.

Assessment/Network Fees

Acquirers (banks) charge assessment fees to processors, averaging $0.01 – $0.05 per transaction.

Markups

Some processors artificially inflate rates above the true interchange cost. Choose processors providing “interchange-plus” pricing for the most transparency.

Payment Processor Fees

Processors charge a rate per transaction, plus possible additional monthly fees for things like PCI compliance or account minimums. These rates can vary wildly between processors, from about 2.4% on the low end up to 4%+ at the high end.

Processors also dictate terminal lease fees if your restaurant uses their payment hardware. These average $25-$100 monthly depending on features.

Chargebacks

If a customer disputes a credit card payment your restaurant received, the issuing bank may initiate a chargeback to recuperate those funds. Expect fees around $15 – $100 per chargeback to cover administration costs. Plus you lose the transaction amount.

PCI Compliance Fees

If your processor manages PCI security standards for you, they may charge around $25 – $50 monthly for this service. Or this cost could get bundled into higher transaction fees instead.

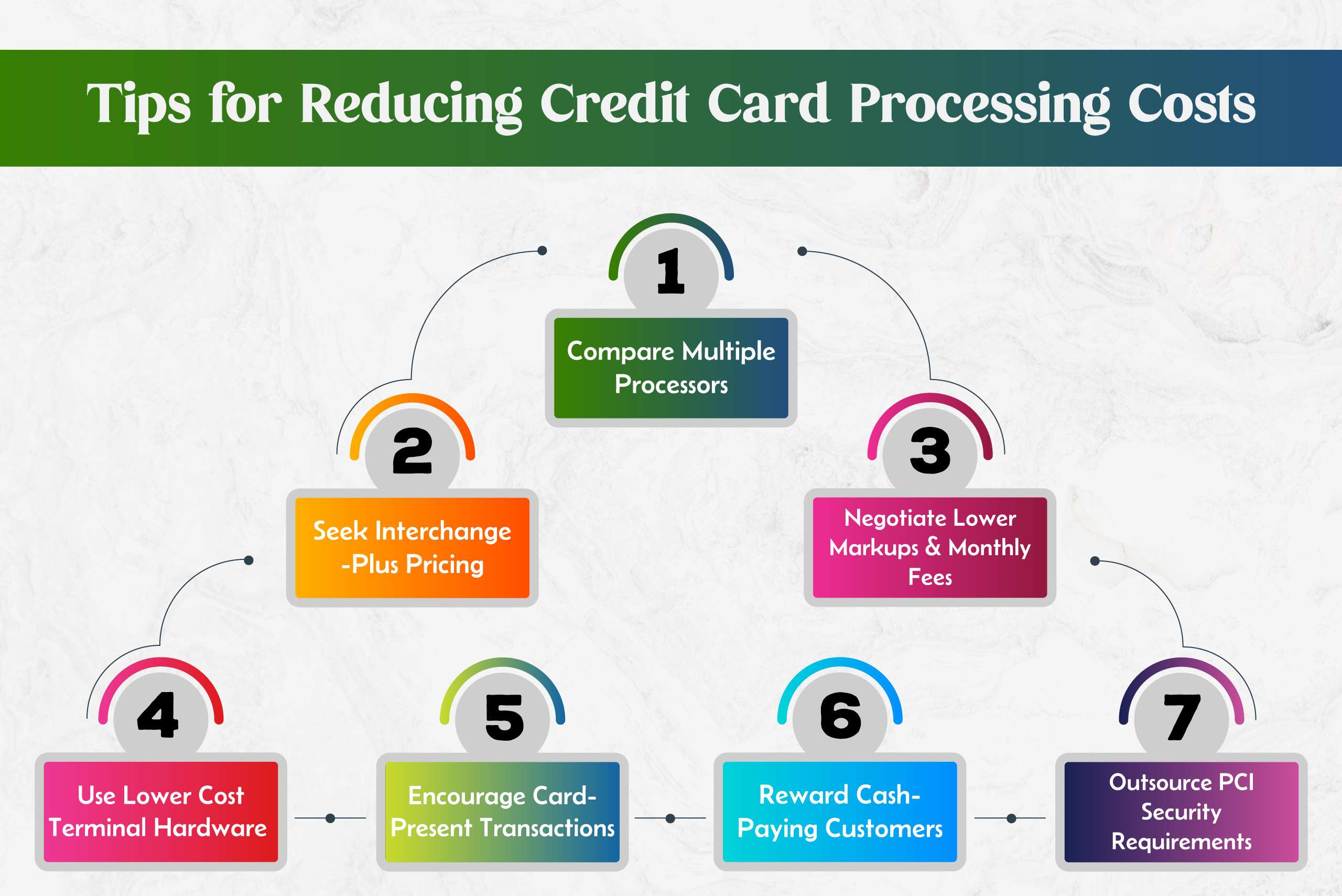

Tips for Reducing Credit Card Processing Costs

Now that you understand the typical credit card processing fees involved for restaurants, let’s look at some tips for minimizing these expenses so your profits don’t take a big hit.

Beyond negotiating with your current provider, consider exploring revolutionary payment processors like Ezzy Payment aiming to reduce friction and costs for restaurants. With custom-configured POS integrations, interchange-plus pricing, and top-rated customer service, Ezzy Payment stands ready to optimize your credit card processing operations. Contact their restaurant card processing experts today for a custom quote detailing the exact fees involved so you know you’re getting a fair and honest deal.

Compare Multiple Processors

Rates, contracts, and transparency vary widely among credit card processing companies. Thoroughly compare several providers to lock in the best set of rates and service quality for your restaurant.

Seek Interchange-Plus Pricing

Choose a processor providing interchange-plus pricing so you only pay actual card network rates plus a fixed markup per transaction. This keeps your expenses predictable.

Negotiate Lower Markups & Monthly Fees

See if processors will shave percentage points off their markup rates or waive unnecessary monthly PCI compliance fees to sweeten the deal. Especially for larger restaurants with higher sales volumes.

Use Lower Cost Terminal Hardware

If your restaurant processes over $10K in card payments monthly, consider purchasing your own EMV-chip enabled terminals instead of pricey leases. This cuts down on monthly equipment fees.

Just ensure the terminals integrate smoothly with your payment processor.

Encourage Card-Present Transactions

Card-present purchases via chip cards and contactless tap payments qualify for lower interchange fees compared to online orders or over-the-phone payments.

Reward Cash-Paying Customers

Cash transactions avoid credit card processing fees altogether. Consider offering a small discount or loyalty perks to diners who pay cash.

Outsource PCI Security Requirements

Letting your processor manage mandatory credit card data security compliance lightens your burden. Just be aware of any PCI compliance fees getting tacked on.

The Bottom Line

Credit cards dominate the restaurant industry today, accounting for well over half of all transactions. With more consumers migrating away from cash, accepting card payments is no longer optional. It’s absolutely vital for staying competitive.

Yet many restaurant owners grapple with navigating the nested fees involved and selecting systems that seamlessly support their operations without draining profits.

Understanding card processing costs, vetting providers thoroughly, and implementing the right POS integrations will go a long way toward easing payments friction. This allows you to focus on delighting patrons with winning food and hospitality instead!